- Nuclear power plant operators can apply for financial credits to fend off closure.

- Just one nuclear reactor has started construction in the U.S. in the past three decades, despite nuclear being a carbon-free power-generation opportunity.

- A Department of Energy Civil Nuclear Credit Program will provide $6 billion in funding to financially-strapped nuclear plants to keep them churning out clean energy.

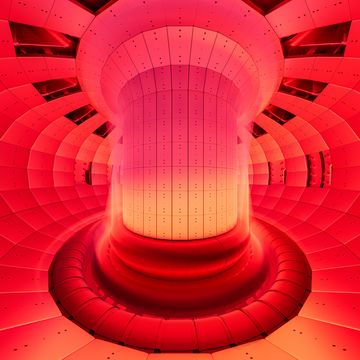

Owners and operators of financially-distressed nuclear power reactors in the U.S. now have access to $6 billion in federal money to help keep their carbon-free power plants churning out electricity. And in a climate that hasn’t seen a boom of new nuclear power plants in more than 30 years, helping older ones compete is a focused attempt at staving off closures—and keeping up supplies of clean energy.

🔋 You love energy stories. So do we. Let’s nerd out over them together—join Pop Mech Pro.

The newly-announced Department of Energy (DOE) Civil Nuclear Credit Program aims to “support the continued operation of U.S. nuclear reactors, the nation’s largest source of clean energy.” Any owners or operators at risk of shuttering due to economic factors can breathe a sigh of relief and apply for funding. Applicants submit sealed bids for an allocation of credits.

Placing a government-led financial priority on nuclear power hasn’t happened at this scale in the history of the United States, and may help operators also competing against policies and credits that support wind and solar power.

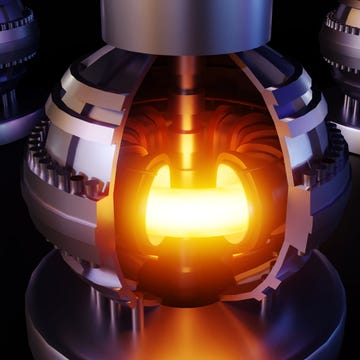

Commercial nuclear power plants debuted and began energy production in the U.S. in 1958. Now, 28 states have at least one commercial nuclear reactor—Illinois dominates with 11 reactors at six plants. Production peaked in 2012, according to the U.S. Energy Information Administration, with 104 operating reactors producing 102,000 megawatts of power. (For context, one megawatt of capacity can supply a year’s worth of electricity to 400 to 900 homes.)

Now, the country’s generation capacity is over 95,000 megawatts across 93 reactors at 55 commercial plants. The last few years have seen an increase in production even as more plants close. The uptick in power generation, thanks to plant upgrades and modifications, has resulted in nearly 20 percent of the country’s annual electricity generation coming from nuclear, equating to about half the carbon-free energy produced in the U.S.

With roughly one-quarter of the country’s nuclear plants at risk of shutting down due to economic reasons, according to the DOE, the investment comes amidst announcements of additional plant closures, even as some states help existing plants remain operable.

☢️ The 6 Largest Nuclear Power Plants in the U.S.

• Palo Verde Generating Station in Arizona has three reactors, built in the late 1980s, generating 3.93GW of electricity annually.

• Browns Ferry Nuclear Plant in Alabama has three reactors, built in the mid-1970s, annually offering 3.4GW of electricity.

• Peach Bottom Atomic Power Station on the Susquehanna River in Pennsylvania has two reactors that came online in 1974 and generate 2.77GW of electricity annually.

• South Texas Project Electric Generating Station near Bay City along the Colorado River has two reactors, opened in 1988 and 1989, that generate 2.7GW annually.

• Oconee Nuclear Station is the only other three-reactor site in the country, built between 1967 and 1974 in Seneca, South Carolina. It generates 2.61GW of electricity each year.

• Susquehanna Steam Electric Station in Pennsylvania has two reactors generating 2.6GW hours of electricity.

Since 2013, 12 commercial reactors have closed—including in New York, Massachusetts, Nebraska, and Iowa—and none have opened. At least seven more have announced plans to shutter in the next three years, including Diablo Canyon, the last remaining nuclear power plant in California. The only plant under construction, units three and four of the Vogtle plant in Georgia, has suffered rising construction costs and delays. The 2012 approval for construction in Georgia was the first new nuclear plant approved in over 30 years.

New companies have their eyes on the future. Oregon-based company, NuScale Power, has approval to build test reactors in Idaho in 2029 and 2030. Meanwhile, the Bill Gates-founded TerraPower has plans—and $2 billion in government funding—for an advanced nuclear reactor at a retiring coal plant in Wyoming, with construction possibly starting in 2024. But that future doesn’t help an existing aging fleet of nuclear power plants.

Tim Newcomb is a journalist based in the Pacific Northwest. He covers stadiums, sneakers, gear, infrastructure, and more for a variety of publications, including Popular Mechanics. His favorite interviews have included sit-downs with Roger Federer in Switzerland, Kobe Bryant in Los Angeles, and Tinker Hatfield in Portland.